Starting to earn at a young age is a significant milestone—but what you do with your earnings is what truly shapes your financial future. Among the smartest moves you can make early on is to begin investing. If you’re wondering how to start investing, this detailed guide walks you through every step—from managing your expenses to selecting the right investment tools.

Step 1: Understand Your Expenses First

Before you think about investing, you need a clear understanding of your monthly obligations.

Track your essential expenses—rent, food, utilities, commute, EMIs.

Then assess how much you can realistically save each month.

The amount you’re left with becomes your starting investment capital.

Step 2: Build a Simple Budget Plan

No investment strategy can succeed without a solid budget.

A popular and easy-to-follow rule is the 50-30-20 Rule:

50% for essential expenses

30% for lifestyle or discretionary expenses

20% for savings and investments

Ideally, try to allocate at least 10% of your income solely for investments.

Step 3: Prioritize Financial Protection First

Before jumping into investments, make sure you’re financially protected.

Term Life Insurance: Ensures your family is covered in your absence.

Health Insurance: Shields you from unexpected medical costs.

Only after securing these should you actively invest.

Step 4: Learn the Basics of Finance

Don’t invest blindly. Take time to understand the different types of investment options:

Mutual Funds, SIPs, Public Provident Fund (PPF), Fixed Deposits (FD), Stock Market, etc.

Use platforms like Zerodha Varsity, Groww, and reliable YouTube channels for free, accessible learning.

Step 5: Start Small, But Start Now

You don’t need thousands to start investing. Even ₹500 a month is enough.

What matters more than the amount is your discipline and consistency.

Step 6: Begin with SIPs (Systematic Investment Plans)

SIP is one of the safest and most structured ways to enter the world of mutual funds.

You invest a fixed amount every month.

Start with as little as ₹500.

Over the long term (10+ years), SIPs can generate significant returns thanks to the power of compounding.

Step 7: Explore PPF – Safe and Tax-Free

Public Provident Fund (PPF) is a government-backed, long-term savings scheme.

You can invest from ₹500 to ₹1.5 lakh per year.

Comes with a lock-in period of 15 years.

Offers tax benefits under Section 80C and guaranteed returns.

A great option if you’re looking for safe, long-term investments.

Step 8: Choose Low-Risk Instruments (If You’re a Beginner)

If you’re new to financial markets, avoid direct stocks or high-risk assets.

Start with safer instruments like:

Mutual Funds (through SIPs)

PPF

Recurring Deposits (RDs)

These give you reasonable returns with minimal risk.

Step 9: Stay Consistent—No Matter What

The key to successful investing isn’t timing—it’s consistency.

Don’t invest one month and skip the next.

Avoid panic withdrawals due to market fluctuations.

Stick to your investment plan every month, like clockwork.

Step 10: Avoid Common Mistakes

Don’t invest what’s left after spending—invest first, spend later.

Don’t follow friends’ advice blindly—do your own research.

Avoid risky investments like crypto, futures, options, especially without deep knowledge.

Be cautious with credit card usage—don’t fund investments on borrowed money.

Step 11: Set Clear Financial Goals

Every investment must have a purpose.

Short-term Goal: Buy a bike in 3 years.

Medium-term Goal: Buy a house in 5 years.

Long-term Goal: Build wealth or financial freedom over 10+ years.

Align your investments with your life goals.

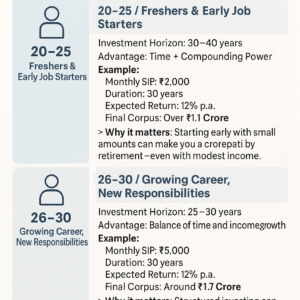

Investment Benefits by Age Group

Understanding how investments grow over time is crucial. Here’s a breakdown of the potential benefits based on when you start:

Age Group: 20–25 (Freshers & Early Job Starters)

Investment Horizon: 30–40 years

Advantage: Time + Compounding Power

Example:

Monthly SIP: ₹2,000

Duration: 35 years

Expected Return: 12% p.a.

Final Corpus: Over ₹1.1 Crore

Why it matters: Starting early with small amounts can make you a crorepati by retirement—even with modest income.

Age Group: 26–30 (Growing Career, New Responsibilities)

Investment Horizon: 25–30 years

Advantage: Balance of time and income growth

Example:

Monthly SIP: ₹5,000

Duration: 30 years

Expected Return: 12% p.a.

Final Corpus: Around ₹1.7 Crore

Why it matters: With increased income, investing more can make up for a slightly late start.

Age Group: 31–40 (Family, EMIs, Education Planning)

Investment Horizon: 15–25 years

Advantage: Stable income + clarity in goals

Example:

Monthly SIP: ₹10,000

Duration: 20 years

Expected Return: 12% p.a.

Final Corpus: Around ₹76 Lakhs

Why it matters: Structured investing can help manage education funds, home loans, and future retirement—despite more responsibilities.

Age Group: 40–50 (Peak Career, Focus on Retirement)

Investment Horizon: 10–15 years

Advantage: Higher investing capacity

Example:

Monthly SIP: ₹15,000

Duration: 15 years

Expected Return: 12% p.a.

Final Corpus: Around ₹61 Lakhs

Why it matters: Though time is limited, high income allows aggressive investing for a secure retirement.

Start Early, Stay Wise: Conclusion

Every age group has its advantage—but starting early gives you the greatest edge. Even a small delay can drastically reduce your future wealth. No matter your age, the best time to start is now.

Investing early in life can be one of the greatest financial decisions you ever make. You don’t need to be rich to start investing—you need to be disciplined, consistent, and informed.

With the right plan and a clear mindset, your small investments today can turn into strong financial foundations tomorrow.

GET GST REGISTRATION

Frequently Asked Questions

Starting early gives you the power of compounding, helping your money grow exponentially over time. It also builds financial discipline and gives you a head start toward long-term goals like buying a home or achieving financial freedom.

Aim to invest at least 10-20% of your monthly income. Even starting with just ₹500–₹1000 is enough to build a consistent habit and grow wealth over time.

For beginners, the safest and most reliable options include:

SIP in Mutual Funds

Public Provident Fund (PPF)

Recurring Deposits (RDs)

These provide a good balance of returns and low risk.

Term Life Insurance protects your family.

Health Insurance covers medical emergencies.

Once you’re financially protected, you can safely start investing.

Absolutely! You don’t need a large salary to start. Consistency matters more than the amount. Start small, stay regular, and increase your investments as your income grows.