On 1st Feb 2025, Saturday. Indian Finance Minister Nirmala Sitharaman was presenting the union budget for 2025. On this budget, there were important, notable, and shocking changes in indirect tax for FY 2025-26; they should reduce their slab rates, and also the tax rebate u/s 87A was increased by ₹60,000, which leads to there being no income tax payable up to Rs. ₹12,00,000. As of now, all know this well: after the budget proposal, most of the social media influencers are posting videos about this. There is a tax saving of up to ₹12 Lakhs, but some are only told about the secret to saving taxes on earnings of more than ₹12 Lakhs.

Yes, if you earn more than ₹12 Lakhs, you also have tax savings. Using the marginal relief u/s 89, but having some restrictions and rules is there. Here we can break down the marginal relief.

What is Marginal Relief?

In India, marginal relief is a provision of the Income Tax Act 1961. Section 87A provides relief to the taxpayer who has slightly increased their income from the given threshold limit, leading to paying more tax. In this situation, marginal relief helps to avoid more tax to reduce the tax burden for the taxpayers small increase the income from the given threshold limit, leading to paying more tax. In this situation, marginal relief helps to avoid more tax for the taxpayers and to reduce the tax burden for the taxpayers.

Who is eligible to claim Marginal Relief under the Union Budget 2025?

Union Budget 2025: Marginal relief is only eligible for the below:

Resident Individual – if her/his income is both salary and non-salary income.

Income Range for Claim Marginal relief should be taxable income between ₹12 Lakhs and ₹12.75 Lakhs.

Who is Not Eligible

Non-residents, companies, Hindu Undivided Family HUFs, and other entities are not eligible to claim marginal relief.

Marginal relief presented in the Union budget 2025

Now there is no tax up to ₹12 Lakhs of total income; this is a basic threshold limit for taxpayers without paying any tax. For salary income excess up to ₹12.75 Lakhs gross income without deducting the standard deduction Under section 16(i) of the Income Tax Act.

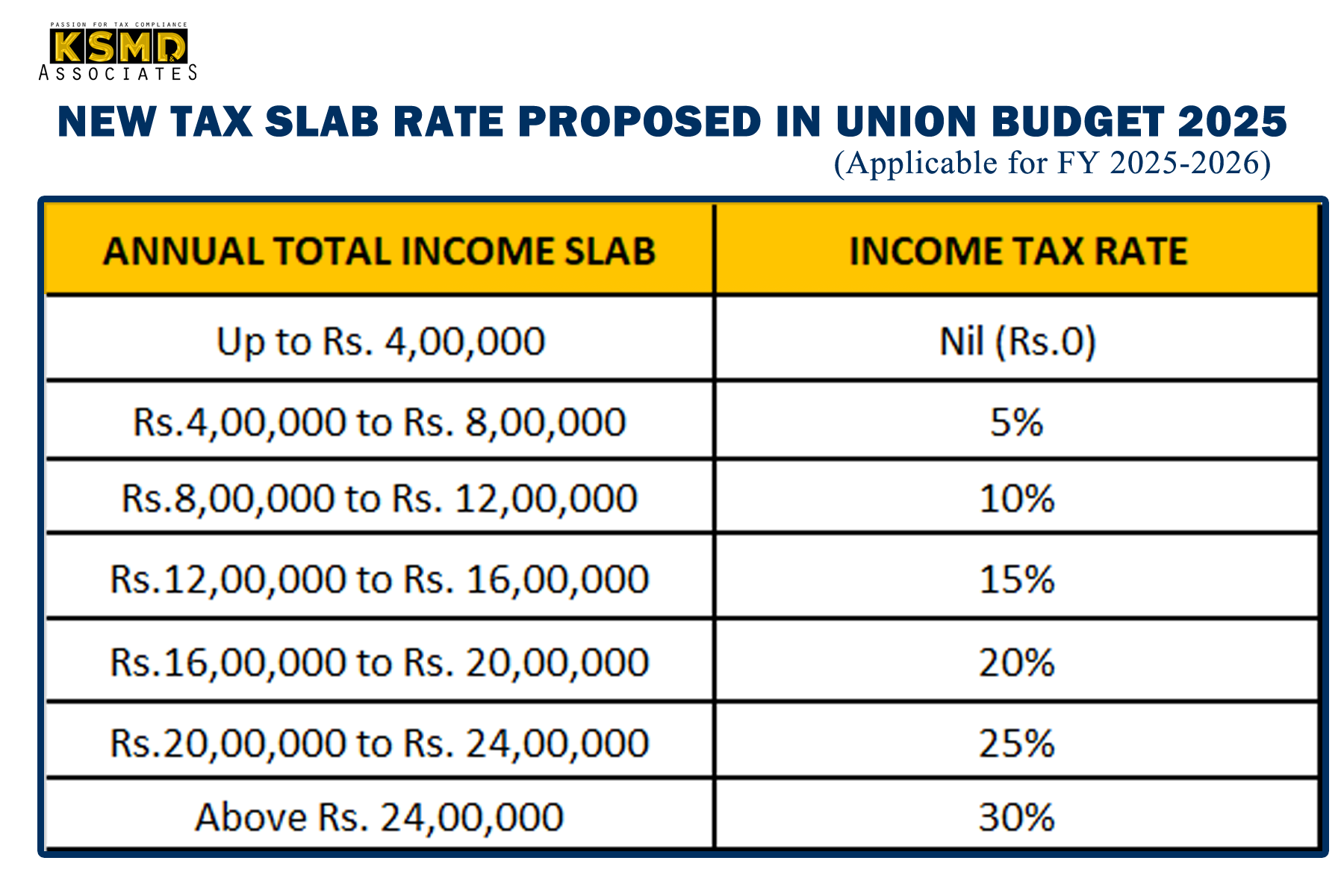

If income exceeds this threshold limit, you need to pay tax based on the latest slab rate introduced in the union budget for FY 2025-2026.

Due to this small hike on the threshold limit affecting you to pay more tax payable, this budget introduced marginal relief for these threshold limits.

Example:

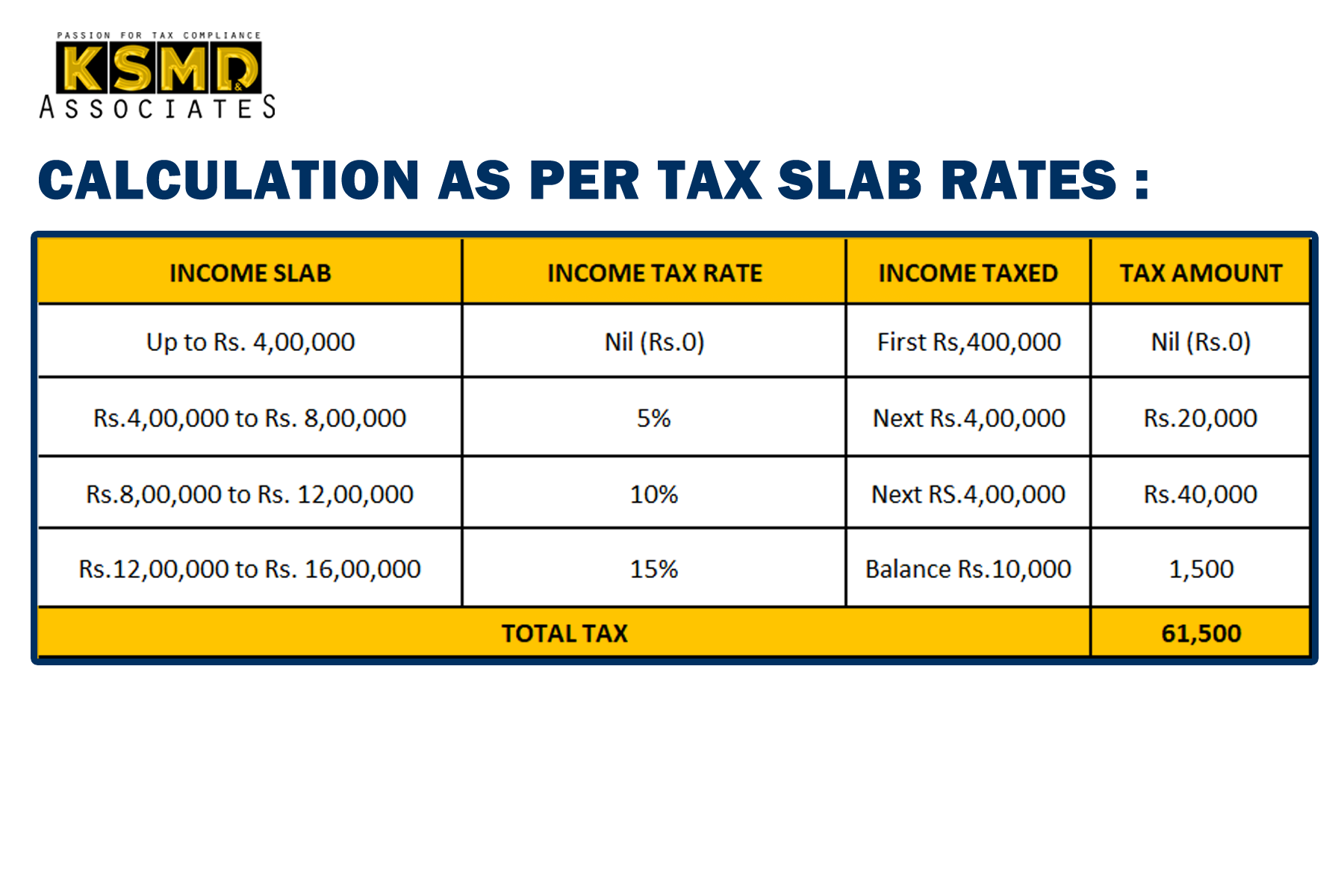

If your annual gross salary is ₹12,85,000/-

Less: Standard Deduction U/s 16(I) ₹75,000,

Now your Total income is ₹12,10,000/- (12,85,000 – 75,000).

i.e., your income exceeds Rs. ₹12 Lakhs by ₹10,000.

Due to this excess income, the threshold limits affect your tax payable calculated as per the slab rate.

*4% cess to be included on total tax; after that, you get your total tax payable / liability.

Without marginal relief, you Tax liability of ₹61,500/- (excluding Cess).

After applied Marginal Relief U/s 89 your tax liability should be ₹10,000/-(excluding cess)

You have a Tax saving of ₹51,500/- by using marginal relief u/s 89.

How marginal relief works

In the above example, there is a total income of ₹12,10,000/-. The excess of ₹10,000/- income earned should lead to more tax of ₹ 61,500/-, but the government needs to provide some relief to this slight of higher income by the taxpayers, so they decided to reduce the tax burden.

My dear taxpayer, you don’t need to pay a tax of ₹61,500/-. Instead of this, the taxpayer can pay how much excess they should pay as a tax, So instead of ₹61,500, pay ₹10,000 as a tax.

I thought, did you understand this? If not, I will also provide you with one of the best-case scenarios.

Scenario: Mrs. SK’s Tax Calculation

Here are Mr. SK’s income details for FY 2025-26 below:

Gross Salary – ₹ 12,00,000

Bonus Earned – ₹.1,00,000

Total Gross Taxable Income – ₹13,00,000

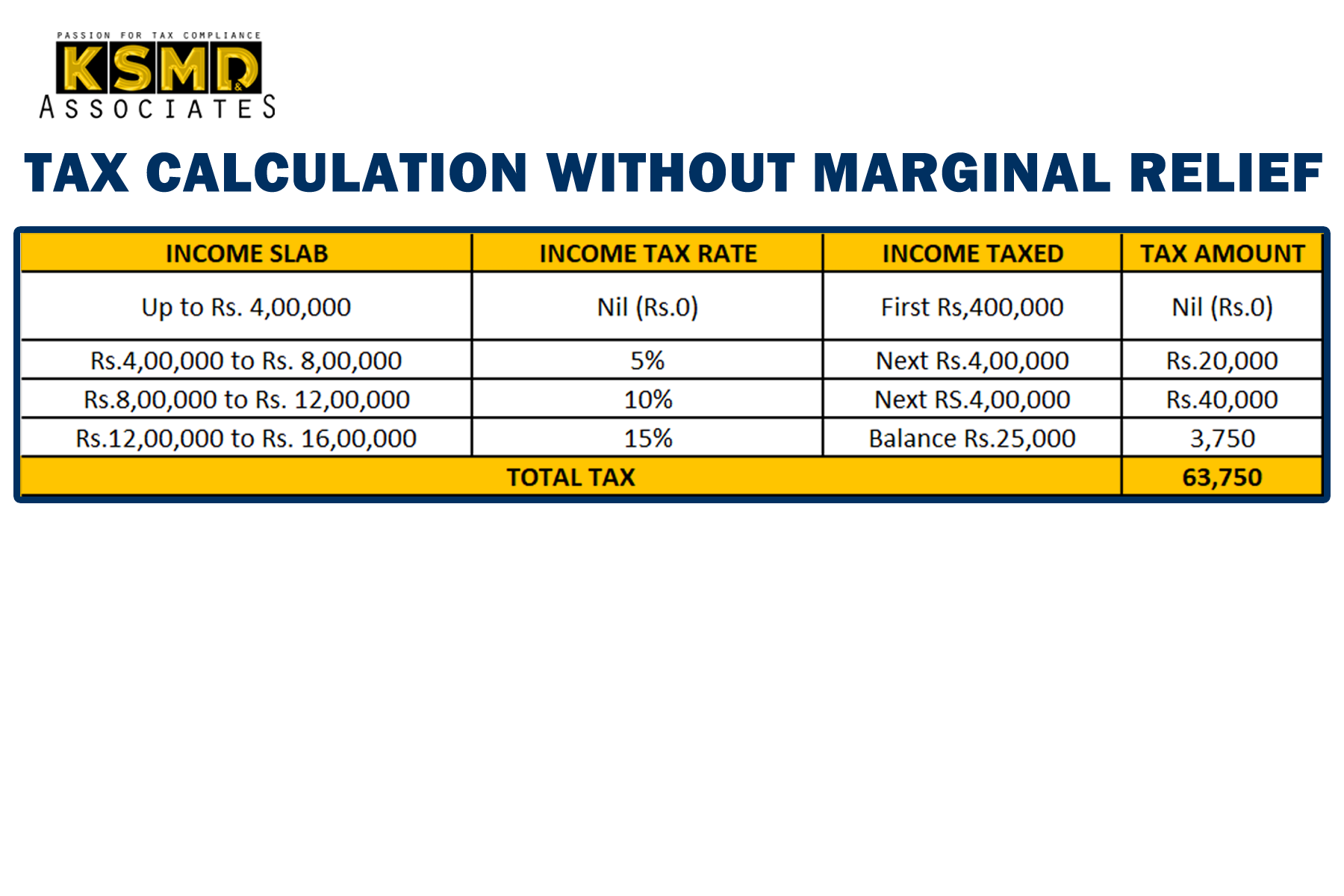

Here is the calculation :

a) Gross Taxable Income – ₹ 13,00,000

b) Less: Standard deduction u/s 16(i) – ( ₹ 75,000)

c) Net Taxable Income (a-b=c) – ₹ 12,25,000/-

Mrs. SK is liable to pay a tax of ₹63,750 (excluding cess) without marginal relief.

But wait. Until the magic of tax saving happens.

Here is the magic of marginal relief.

After implementing marginal relief, Mrs. SK is liable to pay a tax of ₹25,000 (excluding cess).

After magic, the tax saving should be ₹38,750 [63,750 – (25,000)].

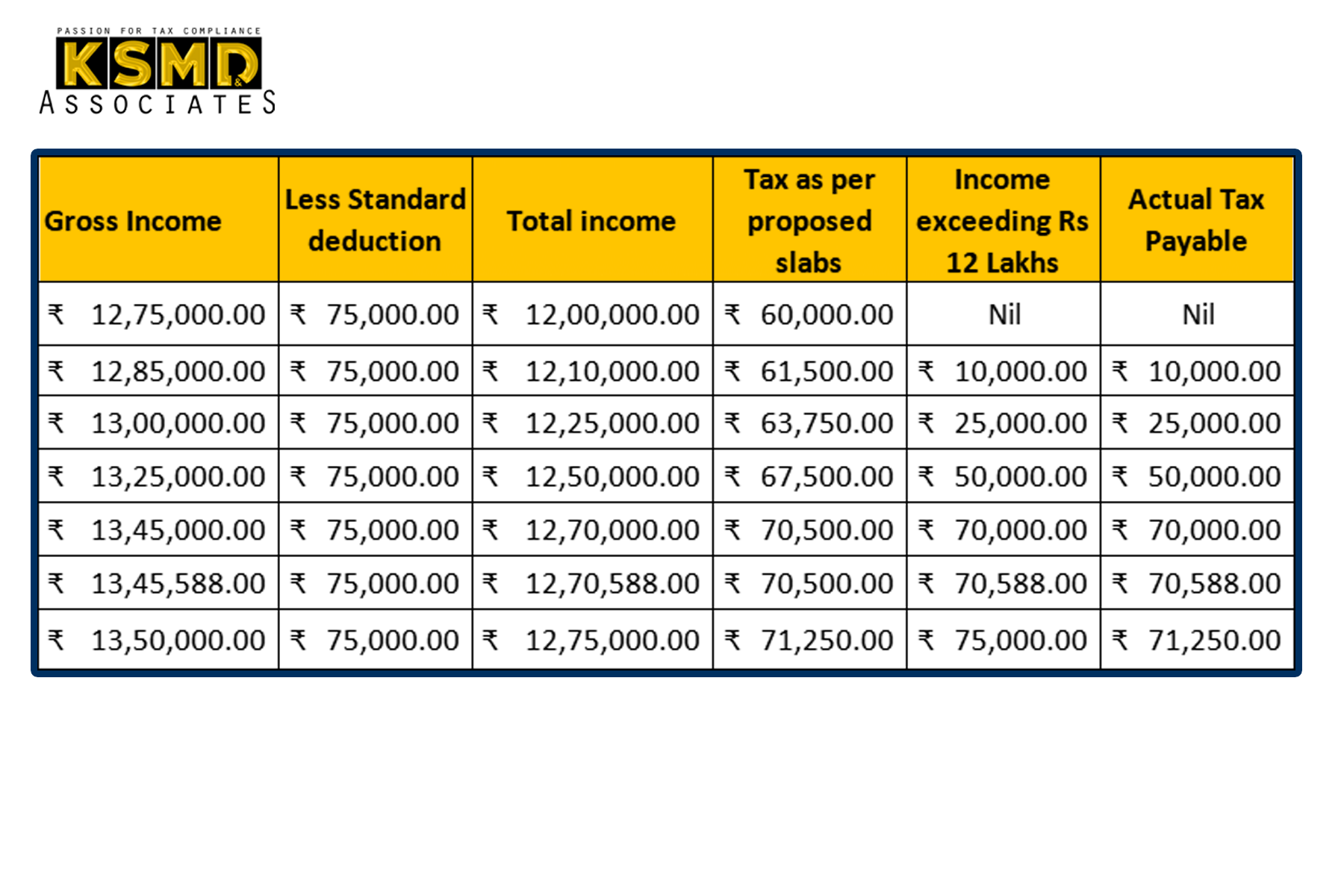

Comparison between Tax calculation with & without Marginal relief

In the table, the last column is the break-even point.

Break-even point

Taxpayers can claim marginal relief up to a total income of ₹12,75,000/-. After that, I am not able to claim marginal relief.

Total income ₹12,75,000/-; tax liability for that is ₹71,250/-.

Total income is ₹12,75,000/-.

The threshold limit is ₹12,00,000/-.

Excess of income above the threshold limit is ₹ 75,000 [12,75,000 – (12,00,000)].

i.e., excess income above the threshold limit of ₹ 75,000 should exceed the tax as per the slab rates of ₹ 71,250/-, so you need to pay tax as per the slab rates. ₹71,250/-

This will help you to reduce the tax.

Advantages of Marginal Relief

Governments encourage taxpayers to

Earning more income: Individuals can earn more tax without any tax burden.

Support the middle class : reducing the tax burden.